Latest Headlines

Carbon Introduces Carbon Zero, A Buy Now Pay Later service, into its Banking App

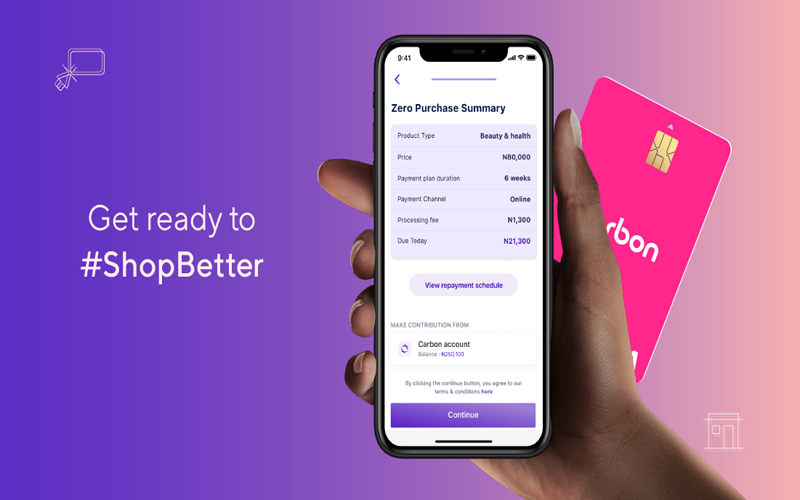

Carbon, a digital bank active in Nigeria, Kenya, and Ghana has today announced the rollout of its buy now, pay later product dubbed ‘Carbon Zero’ to eligible customers on its mobile application. Carbon Zero gives Carbon cardholders the option to split purchases into four installments, to be paid back over time at a zero interest rate.

With spending decisions getting harder to make – cue in the rise of budgeting apps – it could take days, weeks, or even months to buy desired items. Carbon has made it easier for people to get items exactly when they need them. Customers can conveniently split payments into four interest-free installments over six weeks, all at a fair and transparent cost. They also receive value for the items upon payment of the first installment (25% of total cost) at the time of purchase.

Buy now, pay later services are not new — but what makes Carbon Zero stand out from credit card companies and digital lenders in the space is that Carbon Zero, as the name suggests, does not charge customers any interest. With Carbon Zero, the Bank is removing exorbitant fees and creating a more financially responsible way to pay.

Another key differentiator for Carbon Zero is its availability across various stores and not just its affiliate store partners. Customers have access to an unlimited range of products and brands in fashion and beauty categories, gadgets, furniture, electronics, and more service-based experiences like travel, education, and healthcare.

By adopting a direct-to-customer (D2C) approach, Carbon has become the first BNPL provider in Africa to offer a merchant-agnostic payment experience, as customers can shop anywhere Visa cards are accepted.

Ibrahim Ayenajeh, Product Manager of Carbon Zero, mentions: “As humans, our most important and expensive asset is time. Zero is a payment option that significantly shortens the time to achieve a better quality of life for individuals. We are providing consumers the ability to be more flexible with their funds and extend a helping hand for those short periods funds may not necessarily be available.”

Carbon Zero is accessible to all Carbon account holders who have carried out a minimum of 3 transactions worth ₦5,000 each with their Carbon Visa Debit Card. Eligible customers are given a pre-approved limit – up to a maximum of ₦100,000 – which they can use to make a Zero Payment. It has a minimum purchase value of ₦5,000 and can be used for both online and in-person (POS) purchases.

“Carbon has also invested in making this process as seamless and efficient as possible; using data and analytics to assess customers and provide them with pre-approval limits that fit their financial profiles, ensuring responsible spending,” Ibrahim said.

Carbon account holders who want to Pay with Zero would need to make sure they are running the latest version of the Carbon app, then go to ‘Carbon Zero’ from the ‘Home tab’ and select the prompts to fund a purchase (where they would also make the 25% down payment). Funds are then made available to the customer via their Carbon Debit Card to make online or in-store purchases.

To learn more about Carbon’s buy now, pay later product, customers and interested shoppers can visit the Carbon Zero website.

Carbon Microfinance Bank (formerly PayLater) is a pan-African digital bank empowering individuals with access to a more rewarding banking experience. Whether it’s high-yield investments, free bank transfers, flexible loans, interest savings accounts, or zero-interest payment plans on consumer purchases, Carbon is focused on connecting all people with the financial means they need to pursue a life of dignity and prosperity.