CREATE SOLID WEALTH

Grace Agada

A wealth creator is someone who has the ability to create wealth and manage existing wealth well. Most wealth creators are members of the First generation. This means that they are the first people to create wealth in their families. They created their wealth by solving real problems. According to the Forbes 400 Rich List, about 80% of wealth creators created their wealth from scratch.

This implies that they grew up in poverty and from families with zero wealth advantage. As these wealth creators form their own families, they birth their own children who then form the second generation. But unlike the first generation that created wealth. The second generation thrives on existing wealth. It is as if something happens that makes it hard for the second generation to create their own wealth.

They fail to create wealth and they also fail to manage existing wealth well. But why is this so? The answer is simple. The second generation grew up in the midst of wealth. Unlike their fathers who grew up in poverty. The second generation grew up in an environment decorated with the privileges of wealth. They enjoy these privileges not because they earn them but because of their golden bloodline. This is the real reason why the second generation fails to produce wealth. When wealth is lacking in an environment as was evident in the case of the wealth creators.

It makes perfect sense to strive towards wealth. But when wealth is in abundant supply as is evident in the case of the second generation it makes no sense to strive for more wealth. Even the most self-motivated person can become lazy in the midst of abundant wealth. But who made wealth available to the second generation in the first place? The wealth creators did. Wealth creators in the bid to create a perfect environment for their children have created their own worse nightmares. By surrounding their children with the perfect life they did not have, they kill the motivation to strive for wealth. Perfect is seldom what a child needs to develop into a wealth creator. Beyond certain limits, wealth becomes detrimental, not beneficial. The more wealth is made available to a child the faster the child disintegrates from a wealth creator into a dependent beneficiary.

If you take any child from age ONE, who can talk, walk and express themselves, you will see wealth creator like attributes displayed in no time. You will find that they are curious, daring, competitive, fearless, good negotiators and love to take risks. You will also find that they are creative, likable, and lovers of money. They did not get these traits from any school. They came into the world with it. Unfortunately, parents deaden these traits on arrival. As soon a child begins to grow, he is told to conform rather than stand out and be different. Children are praised when they obey blindly than when they question authority.

They are silenced when they ask thought provoking questions and they are shielded from life many valuable lessons. From the moment a child is born it is as if wealth creators are recreating the child. They are recreating the child from who they are to whom they want them to be. They encourage their children to pursue careers they wished they had pursued. They ask them to take jobs that give them bragging rights among their friends. They force children to join family businesses just to make them look good. The result is a child that is transformed from a fearless wealth creator to a dependent, loyal and conforming beneficiary. This child cannot create wealth at best he destroys the wealth that has been created. If wealth creators must reproduce their kind in the next generation, they must change their ways.

So what can wealth creators do to turn things around?

Wealth creators can do three things.

First wealth creators must recognize that pain and the disgust for poverty were the key factors that led to their development as wealth creators. This pain factor is missing in the second generation. The second generation has been conditioned to a life of ease. They have access to money that is beyond their means. Money is given to them without accountability. Even when they work, their lifestyle surpasses their salary and when they incur debt it is waived for free. This kind of attitude breeds a mentality of dependence rather than independence. Wealth creators must change their ways.

Second, wealth creators must redesign the family environment to reflect some of the experiences that supported their own development. They must find ways to integrate delayed gratification, sound work ethics and the effective management of resources in their family environment. Third, wealth creators must leverage on the family bank system to teach their children about money and control access to money. If children must become responsible wealth creators, they must earn and manage their own money. Earning their own money makes them derive fulfillment from their own hard work. It takes away the guilt of free money and helps them put money to more productive use. Money that is beneficial is never bestowed. With the right family bank system, wealth creators can help their children learn how to create new wealth, manage existing wealth and make wealth last for many generations.

To perpetuate wealth across many generations, the children in your family must know two things. They must know how to create new wealth and they must know how to manage existing wealth well. If the next generations are dependent beneficiaries, they will eat wealth without fail. But if they are wealth creators, wealth will last for many generations. The goal for wealth creators is to answer certain key questions that will put them in the right mindset for change. Will giving my children the life I did not have make it easier or harder for them to succeed? How do I make sure that wealth has a positive impact and not a negative impact on my children? How can I help my children learn the valuable lessons life has thought me?. What kind of environment do I need to create to help them develop into wealth creators? And so on. Parents must redefine what it means to help their children without ruining them. The more unearned wealth you expose your child to the more dependent your child will become.

Creating self-reliant, responsible and independent wealth creators is seldom achieved by making free money available to them.

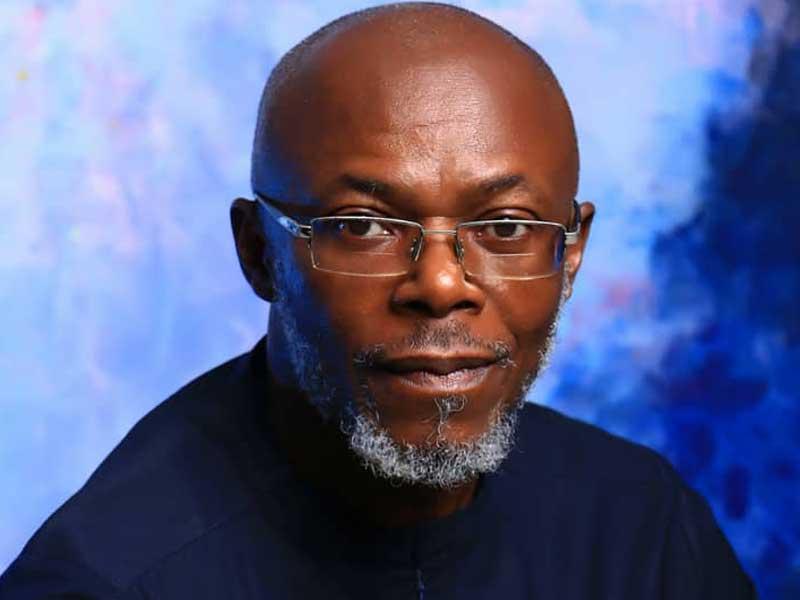

My Short Bio

Agada is a provocative truth-telling wealth advisor, author of the popular Solid Wealth Book, a multi-millionaire entrepreneur, Consultant, and Coach to an exclusive list of top Executives, Investors, and entrepreneurial clients running Businesses from $1-million to $1 billion in size. Grace helps two kinds of people. The first are the people who want to grow existing wealth and the second are the people who want their wealth to last and become irreversible across many generations.

Contact Email: info@createsolidwealth.com